If you’re wondering why British politics feels so haunted - why ministers look hunted, why opposition leaders speak as if under duress, why no one seems free to govern as they please - it’s because they aren’t. The power over budgets now lies not in the Treasury nor even in Parliament but with the bond markets. This is all down to how UK debt was structured in way that brought calamity - and in a way that no one is being honest about. I write about this in my latest Times column. For it, I prepared many graphs in the research that I didn’t use - but would like to share them here, as it’s an important story.

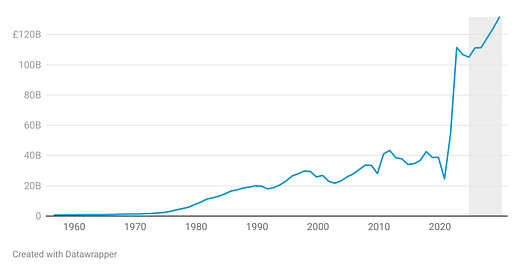

To understand the sheer enormity of what has happened, look at the UK debt interest bill. It was about £40bn before lockdown, falling when QE artificially lowered borrowing rates - but then it was payback time. It is £110bn now - and rising. The below graph summarises the horror story. The grey shows forecasts to 2030: ie, this monster is with us for the foreseeable.

The £110bn of debt interest compares to £60 billion for schools, £55bn for the military, £20bn for the police. So the extra £50bn now being wasted on debt interest could have almost doubled the defence budget, transformed prisons, cut the court backlogs and, yes, cut tax. The irony is that Britain’s national debt is not that bad. At almost 100pc of GDP it is far lower than Japan or America - as the below graph shows.

But the rise in our debt interest has been one of the worst in the developed world. Comparing that rise, as a share of GDP, to other countries the stands as the outright outlier in 2022 and still the worst major-hit major economy in 2023.

So what’s going on? The Americans and Japanese locked in far more of their debt at the long-term rates. The UK gambled. Markets hesitate over UK debt, anxious about all of those unfunded pensions that we keep off the books. One way of easing their qualms is to make debt inflation-proof: so if rates did spike, the UK taxpayers would fork out. The UK did this to an absurd, almost reckless degree. In all, 25pc of UK debt was made inflation-proof - twice as much as the next highest country (Italy). We had offered the mother of all hostages to economic fortune, a point made by the OBR in a 2023 report.

Chapter 4 of that report tells the sorry tale about how we got here. I’ll give you my version. These ‘linkers’ - inflation-linked bonds - worked very well for Britain until they didn’t. Offering to make loans inflation-proof helps flog them, so you borrow at a lower rate - so it’s a saving assuming (as they all did) that inflation, as we once knew it, would not come back. From its independence in 1997, HM Treasury had high confidence in its ability to control inflation and imagined the old tiger had been slain.

The linkers is just one part of the story. Perhaps just as big a factor is the way we did QE. Every country printed money after the crash, but the UK wanted to put HM Government at the front of the queue for cheap debt. The Bank of England bought bonds and turned long-term, future-proofed debt into short-term exposure at the overnight rate. According to the OBR, it has increased the speed at which higher borrowing costs jack up our debt interest bill by a factor of six (!). As its report explains:-

“The impact of a 1 percentage point rise in interest rates within one year has increased by around six-fold from a less than 0.1 per cent of GDP hit to net interest costs at the beginning of the century to about a 0.5 per cent of GDP hit by 2022.”

So QE swapped long-term security for short-term risk by replacing fixed-rate gilts with floating-rate reserves. The Bank of England created £713 billion (!) of these reserves — paying interest at Bank Rate — to buy long-dated gilts during QE. What once seemed a clever accounting trick ended up becoming fiscal hazard: a third of Britain’s debt now tracks monetary policy in real time. It has left us with a unique level of exposure.

When Rishi Sunak became Chancellor he worked all this out: the UK was sitting on a bed of nitroglycerine. I remember him telling me about this at the time: when he was the only person taking a post-lockdown inflationary threat seriously. If rates went up we’d somehow have to find another £50 billion. Every year. He proved right, inflation came roaring back triggering mayhem (LDI crisis, etc), gilt markets dethroned Liz Truss and Sunak ended up presiding over the crisis that he warned about.

We should add, here, is the politics of HM Treasury. It knew it had, in these inflation-linked bonds, created a potential monster. But it also saw the so-called ‘linkers’ as a form of leverage over No10 and other departments, a tool to focus spendthrift minds. You can’t spend too much, HMT would say, or inflation will rise and the ‘linkers’ will detonate! An extra point in rates would cost the UK billions. I spoke to one former minister who was uncomfortable with this tactic and felt HM Treasury was putting the country at risk in a game of brinkmanship with No10. The threat of exploding linkers certainly had no effect on Johnson, who spent like a drunken Keynesian.

So here we are: more at the mercy of market whims than any G7 country with a tearful Chancellor out of options. It reminds me of the Norwegian drama Occupied, where the PM is in hock to invisible forces that he cannot acknowledge. Similarly, Starmer is at the mercy of the gilt markets but will not admit it. He could try to blame the Tories. But he’d have to admit that this game started under Gordon Brown and the first batch of QE, which followed the same strategy of printing money by converting long term fixed debt into floating-rate. Great when rates are on the way down, agony on the way up.

Looking at debt interest as a share of GDP, we are at levels very seldom seen in my lifetime.

I’m afraid it gets even worse. The official UK debt does not factor in our unfunded liabilities: the public sector pensions, etc. This is why markets are increasingly nervous about the UK, our welfare liabilities and our ability to control them. Look closely and you can see we have been struggling to sell longer dated gilts. In his, we see the seeds of a larger funding crisis. And politically, we see failing centrist parties with fist-shaking insurgents promising that they will deliver - but never saying how they’d get the money.

In my column, I talk about the Latin American political cycle.

Fiscal crisis with inflation and interest rates shooting up, necessitating…

Austerity as a right wing government seeks to impose financial order, often through unpopular and authoritarian measures, triggering…

Public anger which leads populists winning elections, promising to fix things not by austerity but going after the rich etc. Which very quickly fails, depletes the tax base, sends inflation and gilt yields soaring. Leading to…

Fiscal crisis. And the doom loop starts again.

Javier Milei is the circuit breaker. But he has had the courage and authority to explain the above to the Argentinian public, and won a democratic mandate for shrinking the state. Only fiscal responsibility, he says, will free people from control by the markets and allow them to break the doom loop. The same is true in Britain but we lack a leader with the credibility and candour to make this case.

We have had years of big state Conservatism, years of Chancellors of left and right spending as much as they thought they could get away with. We have grown used to talk about Chancellor having more ‘fiscal headroom’ as if it was more money to spend. We came to forget the difference between a bank balance and a credit card limit. Living life at the edge of that limit means becoming a slave to the bond markets, as Starmer has now indelibly learned. After a 15-year absence the bond vigilantes are now back, imposing the old order with a vengeance.

I doubt Nigel Farage is in the market for fiscal realism. He is more likely to offer economic populism and fiscal fairytales. Starmer, it seems, thinks all of the above is too complicated (or embarrassing) to explain. But this is the new reality of British politics and will be with us for some time to come.

Great description Fraser. And yes a doom loop it is! We need big decisions from big decision makers to change this spiral. And by the looks of things Starmer and Reeves are not them! But neither is anyone else either. Lots of problem descriptions but little in answers. I’d like to have a go! … the problem as I see it snd funnily enough the answer is in SPENDING! As nothing good happens from not spending! …. And… we all need to understand our tax system as to, ‘how tax is triggered’? Once we all understand that money has to move (SPENDING) and tax has to be funded as a result of a well funded economy we can quickly see that the tax take can be more than sufficient for all our needs! First Fraser I would like to explain why we need spending?…. well, without spending we don’t get any tax revenue to the exchequer. Without spending money that money incurs no tax! None!! Nada!!! So tax is a result of spending so the answer to increase tax revenue is yes, …. More spending! Next, explain why spending (money moving or changing hands) triggers tax? Well…. Surely, income tax is triggered by income? No!! It’s triggered by Spending! Despite Income tax having income in it, it’s only calculated on wages. It’s paid by employers SPENDING on the wages of employees! Without spending for companies to earn they have no money to spend on wages. So by default we see income tax is triggered by spending. Just as VAT and Duty! Also council tax is Spending(as we have to move money by order). So it’s all on spending. Now we know all tax is as a result of money moving or having to change hands let’s look at all the money that isn’t spent? Yes, 5% of people hold 95% of money! And they don’t spend it every month! …. Just think about that?…. Most or rather, nearly all of our money is held by people who don’t spend it! Not just that, they don’t pay any tax on it! You pay no tax on money unspent unused and idle! None! Nada!!! So there we have it Fraser, most money untaxed unspent and held outside our monthly pot! Whereas we have 95% of people holding just 5% of our money fighting over it to pay tax on! No wonder our tax take is insufficient! And who do we borrow off? Yes the 5% who are holding all our money!!! And what do they want? Interest! So they get even richer! OMG! Isn’t that simple? We have an undemocratic few holding all our money to ransom! It’s not just undemocratic it’s unfair! The system is skewed. I’m all for people earning as much as they can but, I’m all for them having to spend it too! Otherwise it isn’t going to work. In short we need to bring back exchange control. No money out of UK. None. Goods can go but not money. Put a ‘spend by date’ on money electronically. Spend it or lose it to the exchequer. Make money move! Make VAT the tax of choice and the tsunami of money being spent each month will definitely fill the coffers of the exchequer! So much so we won’t need any other tax! We can give more in pensions, more in benefits and more in wages with a turbo charged economy. More tax revenue on more money being spent. It would be autonomous and perpetual and streamlined. It would be fair and democratic. And it would fix every problem. No more borrowing. Debate that Fraser?

Does anyone have the courage and authority to explain the effects of Brexit to the British public?